The surprising lessons from a book I thought was for snobs and smugs.

Lessons learned from the classic book Rich Dad, Poor Dad and other Monday Morning thoughts on solving problems and staying in the moment.

🤑 Rich Dad, Poor Dad: lessons learned

This book (Rich Dad, Poor Dad by Robert T Kiyosaki) popped up in lots of must-read business book lists. It felt for me like a really snobby book. I mean, come on… the subtitle literally is “What the Rich Teach Their Kids about Money That the Poor and Middle Class Do Not!”. I decided to give it a chance and just read a chapter, but it was surprisingly good! It talks about the author learning from both his middle-class real dad and the entrepreneurial dad of his best friend. Here’s what I learned:

🧱 Life will push you around

Life will push you around. With every setback, you have a choice of what to do. You can

let life push you around and give up

push back. If you decide to push back, be sure to push back against life instead of getting angry at your boss, job or partner.

welcome life pushing your around, learn from it and move on.

😨 Emotions lead your decisions

In his book, he talks about the rat race and how people are often working for money because of desire. They think it can buy joy. Mostly the joy is fast gone, so they keep working, believing that money will solve their fear and desires.

“Emotions are what make us human. Make us real. The word ‘emotion’ stands for energy in motion. Be truthful about your emotions, and use your mind and emotions in your favour, not against yourself.”

Your two emotions, fear and desire, can easily lead you to the trap of living your life in fear and as a consequence never chasing your dreams.

💸 Financial literacy and what they don’t teach at schools

The rich have money work for them, while the poor and middle-class work for money. In order to become ‘rich’ you need financial literacy. One of the most important elements is knowing the difference between assets and liabilities.

An asset is something that creates money in the long run, such as stocks, a holiday home you rent out, a garage, etc. A liability on the other hand is something that costs you money in the long run, such as buying a car

Investing your money in assets is like planting a tree. If the assets are large enough, they continue to grow by themselves. The rich mostly retire early, but retiring doesn’t always mean not working. It means you have the freedom to choose.

In general, your income should be higher than your expenses, and your assets should be higher than your liabilities. It’s as simple as that. For most people, their income is quite similar to their expenses and their liabilities are bigger than their assets.

You can apply this lesson from the perspective of building your own company or from your daytime job. Lots of businesses fail, so unless you really have a strong desire to be self-employed, stay on your daytime job. But realise what assets are, build them and keep them.

In the real world, after your degrees, your gut factor, your daring, decide your future. We all have big potential and huge talents. It’s often self-doubt that is holding us back.

🤘 Act bold

Most of us feel like something is wrong or could be better in our life. Changing it or upgrading feels hard, however. So we keep on doing the same as before, with some minor changes. That’s literally doing the same thing, but expecting a different result. The author labels this as insanity. Instead, he suggests stopping doing what is not working and looking for something new to do.

This passage from the book hit me the most…

“You’ll live all your life playing it safe, doing the right things, saving yourself for some event that never happens. Then you die a boring old man. You’ll have lots of friends who really like you because you were such a nice hard-working guy. You spent a life playing it safe, doing the right things. But the truth is, you let life push you into submission. Deep down you were terrified of taking risks. You really wanted to win, but the fear of losing was greater than the excitement of winning. Deep inside, you and only you will know you didn’t go for it. You chose to play it safe.”

😍 My Favorite Things of last week

🚐 Mini retirement: We spent the weekend in the snow with our travel van in the south of Belgium. We hadn’t seen much snow yet this winter, but this weekend made everything up. Beautiful hikes and lots of extended white landscapes. We do something like this every month as a mental reset. I referred to these little getaways as a mini-retirement in one of my earlier newsletters.

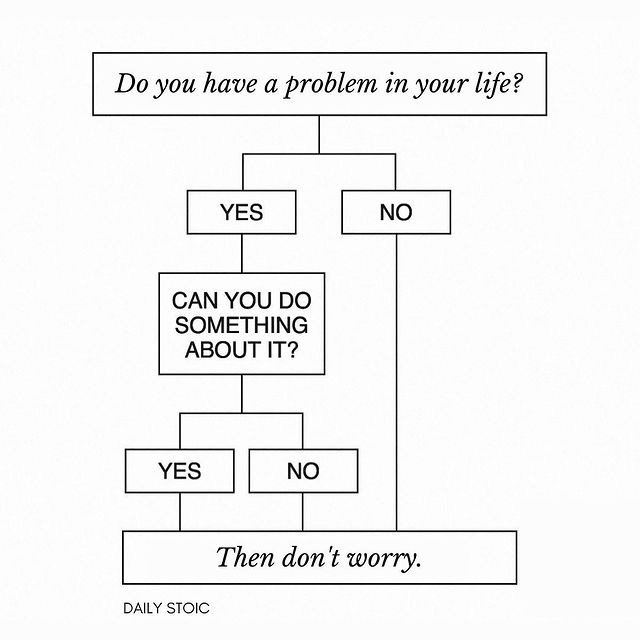

📰 This flowchart post by DailyStoic. So simple, but true!

🗨 Quote of the week

“Winning means being unafraid to lose”

by Fran Tarkenton

✏ Visual of the week

➡ Want to get automatic updates on this (somewhat) weekly newsletter?

One last thing…

If you don’t like it or no longer find it interesting: unsubscribe (no hard feelings). If you feel like you want to ask or add something: go ahead. Any kind of feedback is welcome: worshippers, grammar nazis, and everything in between!